Latest News

ISCV and IJJ are both popular equity ETFs, but how do they compare against one another?

Via The Motley Fool · January 10, 2026

Successful trading involves anticipating what might happen next just as much as reacting to evolving undercurrents.

Via Barchart.com · January 10, 2026

The GBP/USD weekly forecast edges lower as the US dollar gains on upbeat economic data.

Via Talk Markets · January 10, 2026

This steady-Eddie food stock offers a 5.8% dividend yield and currently trades at a decade-low valuation.

Via The Motley Fool · January 10, 2026

Three-month Treasury bill rates ended the week at 3.5125%.

Via Talk Markets · January 10, 2026

Here's What Happens When Someone Opens a Credit Card in Your Namefool.com

Via The Motley Fool · January 10, 2026

Southern Copper Corp (NYSE:SCCO) Stands Out as a Quality Investing Candidatechartmill.com

Via Chartmill · January 10, 2026

Palantir Technologies (NASDAQ:PLTR) Combines Strong Growth with a Favorable Technical Setupchartmill.com

Via Chartmill · January 10, 2026

Via Benzinga · January 10, 2026

Mizuho names Nvidia, Lumentum, and Broadcom as top 2026 chip stocks, citing AI demand and networking growth. Microchip and Lam Research also highlighted.

Via Talk Markets · January 10, 2026

The stock is up by more than 400% over the last year.

Via The Motley Fool · January 10, 2026

Right of offset allows your bank or credit union to withdraw funds from your account to pay certain debts.

Via The Motley Fool · January 10, 2026

PRINCIPAL FINANCIAL GROUP (NASDAQ:PFG) Shows Strong Technicals and Setup for Potential Breakoutchartmill.com

Via Chartmill · January 10, 2026

Danaher Corp (NYSE:DHR) Passes the Caviar Cruise Screen for Quality Investorschartmill.com

Via Chartmill · January 10, 2026

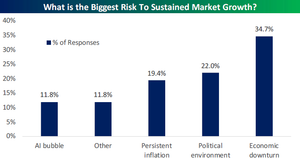

The biggest risks to the market are an

Via Talk Markets · January 10, 2026

Via Benzinga · January 10, 2026

Explore how each ETF’s unique approach to global real estate shapes risk, diversification, and portfolio fit for investors.

Via The Motley Fool · January 10, 2026

Last year saw wild swings in attitudes about the economy and financial markets. Not a bad year overall, but it was a rough ride at times.

Via Talk Markets · January 10, 2026

State benefit taxes are largely fading into the past, but they remain alive and well in these places.

Via The Motley Fool · January 10, 2026

Nano Nuclear Energy has generated huge returns, but it will take multiple years before commercialization even starts.

Via The Motley Fool · January 10, 2026

Banks Push To Limit Stablecoin Rewards Ahead Of Senate’s CLARITY Act Markupstocktwits.com

Via Stocktwits · January 10, 2026

Dr. Reddy's Laboratories-ADR (NYSE:RDY) Passes Peter Lynch's GARP Investment Filterchartmill.com

Via Chartmill · January 10, 2026

The Benzinga Stock Whisper Index highlights five stocks seeing stronger than normal interest from readers and looks at the potential catalysts driving the attention.

Via Benzinga · January 10, 2026

This tech giant could have even more upside than analysts project.

Via The Motley Fool · January 10, 2026

I'm planning to focus on ETFs in 2026, and these are on the top of my buy list.

Via The Motley Fool · January 10, 2026

Tenet Healthcare Corp. (NYSE:THC) Presents a Compelling Value Investment Casechartmill.com

Via Chartmill · January 10, 2026

Raymond James Financial Inc (NYSE:RJF) Shows Strong Technical Setup for Potential Breakoutchartmill.com

Via Chartmill · January 10, 2026

NU Holdings Ltd. (NYSE:NU) Fits the Minervini Trend Template with High Growth Momentumchartmill.com

Via Chartmill · January 10, 2026

Bitdeer Shares Climb After Hours Despite Selling Its Bitcoinstocktwits.com

Via Stocktwits · January 10, 2026

A look at the factors driving the rollercoaster ride in the rare-earth materials and magnets stock.

Via The Motley Fool · January 10, 2026

Benzinga examined the prospects for many investors' favorite stocks over the last week — here's a look at some of our top stories.

Via Benzinga · January 10, 2026

It’s only been a few days since the start of 2026, but global equity markets are already reaching new all-time highs.

Via Talk Markets · January 10, 2026

This investing move could save your portfolio if the market takes a turn for the worse.

Via The Motley Fool · January 10, 2026

The company's share price has taken a hit, dropping over 50% from its 52-week high.

Via The Motley Fool · January 10, 2026

NVIDIA CORP (NASDAQ:NVDA) Presents a Convergent Opportunity of Strong Fundamentals and Bullish Technical Setupchartmill.com

Via Chartmill · January 10, 2026

Independent Bank Corp (NASDAQ:INDB) Shows Minervini Trend Template and High Growth Momentumchartmill.com

Via Chartmill · January 10, 2026

IonQ is seen as the leader among quantum computing pure plays.

Via The Motley Fool · January 10, 2026

Wall Street has a very short memory, but you shouldn't ignore this worrying trend at Altria.

Via The Motley Fool · January 10, 2026

Retail investors talked up five hot stocks this week (Jan. 2 to Jan. 9) on X and Reddit's r/WallStreetBets: GME, NVDA, MSTR, GOOG, TSLA.

Via Benzinga · January 10, 2026

The stock market is showing a strong, broad advance. These names reflect that.

Via Investor's Business Daily · January 10, 2026

Solar panel manufacturers in India are starting to have a hard time sourcing the silver they need.

Via Talk Markets · January 10, 2026

A return to growth in EVs will strengthen the investment case for buying the stock.

Via The Motley Fool · January 10, 2026

flyExclusive is a private jet services provider through on-demand charters, Jet Club memberships, and fractional ownership.

Via Talk Markets · January 10, 2026

These two power players have a long runway of growth ahead.

Via The Motley Fool · January 10, 2026

Rivian's status as a luxury EV maker makes things worse, since people are looking for used cars and entry-level new vehicles.

Via The Motley Fool · January 10, 2026

The YieldMax TSLA Option Income Strategy ETF has a jaw-dropping yield, but another ETF may be more suitable for income investors.

Via The Motley Fool · January 10, 2026

MarketBeat Week in Review – 01/05 - 01/09marketbeat.com

Via MarketBeat · January 10, 2026

When things seem too good to be true on Wall Street is precisely when investors should be concerned.

Via The Motley Fool · January 10, 2026