Latest News

This fiber-optic networking provider to global data centers and telecoms reported a notable insider sale in its latest SEC filing.

Via The Motley Fool · January 10, 2026

There probably won't be any reasons to be euphoric about this asset.

Via The Motley Fool · January 10, 2026

Viasat, a global provider of satellite connectivity solutions, reported significant insider selling amid a year of sharp stock gains.

Via The Motley Fool · January 10, 2026

Via Benzinga · January 10, 2026

USD managed to nicely rise as short-term yields shot up, with the market correctly betting on rate cuts being nearer than before the jobs data.

Via Talk Markets · January 10, 2026

The market turned sharply upward last week. There were numerous all time index highs with good breadth support.

Via Talk Markets · January 10, 2026

Via Talk Markets · January 10, 2026

Given current market valuations and the prolonged bull run stocks have had over the past three years, investors should expect at least two corrections of at least 5-10% in 2026.

Via Talk Markets · January 10, 2026

It's the final "Rule Breaker Investing" podcast of 2025.

Via The Motley Fool · January 10, 2026

CoreWeave stock has slipped in recent weeks.

Via The Motley Fool · January 10, 2026

The unemployment rate edged down to 4.4 percent, which was a drop of 0.1 percentage points from the November rate.

Via Talk Markets · January 10, 2026

This producer of pasture-raised eggs and value-added foods reported a notable insider sale amid a year of share price declines.

Via The Motley Fool · January 10, 2026

Nvidia isn't the only AI name that can help investors reach financial independence over the long term.

Via The Motley Fool · January 10, 2026

The U.S. needs critical minerals. This Canadian company could have them in abundance.

Via The Motley Fool · January 10, 2026

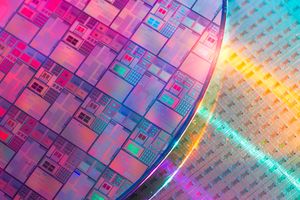

Demand for semiconductors is soaring due to the rising effectiveness of artificial intelligence.

Via The Motley Fool · January 10, 2026

Nvidia's stock is primed to rocket higher this year.

Via The Motley Fool · January 10, 2026

SpaceX will IPO for $1.5 trillion in 2026. Do you wish you could have bought it more than 10 years ago?

Via The Motley Fool · January 10, 2026

JFrog delivers DevOps solutions for enterprise software supply chains; a key insider recently reduced their direct holdings.

Via The Motley Fool · January 10, 2026

NuScale is still years away from commercialization, but a different AI stock's turnaround is about to unfold.

Via The Motley Fool · January 10, 2026

The EUR/USD weekly forecast remains tilted to the downside, as US data shows resilience and fading odds of a January rate cut by the Fed.

Via Talk Markets · January 10, 2026

Explore how VIG and HDV differ in yield, sector focus, and risk—key factors for investors weighing income versus growth strategies.

Via The Motley Fool · January 10, 2026

More than $60,000 per year in Social Security benefits is just three steps away.

Via The Motley Fool · January 10, 2026

Via Benzinga · January 10, 2026

Nike is hoping that it can perform better for shareholders going forward.

Via The Motley Fool · January 10, 2026

Heavy demand from the AI race proved a boon for Taiwan's trade in 2025, with its trade surplus nearly doubling to $157 billion. Tech exports have given a major boost to economic growth in 2025, overshadowing softness in other parts of the economy.

Via Talk Markets · January 10, 2026

Rigetti Computing develops quantum processors and cloud services; a key insider recently trimmed their stake, SEC filings reveal.

Via The Motley Fool · January 10, 2026

President Trump's comments about China's use of wind power appear to overlook the scale of the country's wind energy sector.

Via Benzinga · January 10, 2026

The White House hit back at Tim Walz, arguing Trump's immigration enforcement is cutting crime, improving safety, and reducing fentanyl flows.

Via Benzinga · January 10, 2026

2025 was a tumultuous year for the global healthcare sector. However, a dramatic shift occurred in the final quarter. The sector rebounded strongly. This has created a compelling background, potentially positioning 2026 as a major comeback year.

Via Talk Markets · January 10, 2026

While many cryptocurrencies are highly correlated with tech, these cryptocurrencies are not.

Via The Motley Fool · January 10, 2026

This real estate ETF uses strict criteria to maximize quality assets, but is it good enough to match up against the world's largest global real estate ETF?

Via The Motley Fool · January 10, 2026

Meta’s pause on the global rollout of its Ray-Ban Display smart glasses leaves investors to weigh whether META is a buy, sell, or hold at this pivotal moment.

Via Barchart.com · January 10, 2026

Adobe shares ended Friday’s session lower, sliding nearly 2% after BMO Capital Markets downgraded the software giant and warned that intensifying competition and a lack of near-term catalysts could limit upside for the stock.

Via Talk Markets · January 10, 2026

From fees to diversification, key differences between these tech ETFs could influence your portfolio’s risk and sector exposure.

Via The Motley Fool · January 10, 2026

An elderly couple was swindled out of their $1.3 million retirement fund by scammers pretending to be representatives from the FTC.

Via Benzinga · January 10, 2026

EverCommerce, a SaaS provider for service-based businesses, reported a notable insider sale amid a steady pattern of monthly dispositions.

Via The Motley Fool · January 10, 2026

Via Benzinga · January 10, 2026

Ubiquiti accelerated its growth, paid down debt, and increased shareholder returns.

Via The Motley Fool · January 10, 2026

The exposure that Cambria Global Value ETF GVAL provides can certainly be a valid way to go, no question, but it is not always going to be optimal. Whatever strategy you believe in will not always be an optimal one, which is just fine.

Via Talk Markets · January 10, 2026

Venezuela-related uncertainty continues to weigh on Chevron shares. Can the Street-high price target hold under these conditions?

Via Barchart.com · January 10, 2026

Pony AI and BAIC BJEV expanded their Robotaxi partnership to scale commercialization, cut costs and accelerate global deployment as autonomous mobility demand grows.

Via Benzinga · January 10, 2026

Investing in the pure-play start-ups is not the only way to gain exposure to this nascent technology.

Via The Motley Fool · January 10, 2026

The DAX index has been showing impulsive bullish sequences in the cycle from the November 2025 low. Recently, it pulled back and found buyers. Here’s our forecast for the index.

Via Talk Markets · January 10, 2026

Small-cap stocks have historically outperformed their bigger siblings, and there are three reasons 2026 could see that trend reassert itself.

Via The Motley Fool · January 10, 2026

Legendary mining executive Robert Friedland has emerged as an outspoken advocate for solving the critical minerals shortage.

Via Benzinga · January 10, 2026

Greenland's leadership has firmly rejected President Trump's ongoing efforts to acquire control over the island.

Via Benzinga · January 10, 2026

Want to take your real investments global? These top real estate ETFs offer international income.

Via The Motley Fool · January 10, 2026

Opendoor shares surged on Friday, following President Trump's announcement of a $200 billion plan for mortgage-bond purchases aimed at lowering mortgage rates. This move is expected to boost mortgage originations, thus helping the housing market.

Via Talk Markets · January 10, 2026

You don't need to be a stock market genius to build a million-dollar portfolio.

Via The Motley Fool · January 10, 2026

President Trump has urged major US oil companies to invest at least $100 billion in Venezuela's oil sector, a proposition that has been met with skepticism by industry leaders.

Via Benzinga · January 10, 2026