FedEx Corp (FDX)

359.47

-1.63 (-0.45%)

NYSE · Last Trade: Mar 10th, 4:57 PM EDT

Detailed Quote

| Previous Close | 361.10 |

|---|---|

| Open | 363.30 |

| Bid | 359.50 |

| Ask | 365.68 |

| Day's Range | 358.41 - 368.44 |

| 52 Week Range | 194.29 - 392.86 |

| Volume | 1,521,936 |

| Market Cap | 90.29B |

| PE Ratio (TTM) | 19.88 |

| EPS (TTM) | 18.1 |

| Dividend & Yield | 5.800 (1.61%) |

| 1 Month Average Volume | 1,793,527 |

Chart

About FedEx Corp (FDX)

FedEx Corp is a global logistics and transportation company that provides a wide range of delivery services, including overnight shipping, freight transportation, and supply chain solutions. With a comprehensive network that spans across the globe, FedEx facilitates the timely movement of goods for businesses and consumers, offering innovative solutions that enhance efficiency and reliability. The company’s various segments focus on different aspects of logistics, such as express shipping, ground transportation, and e-commerce solutions, making it a vital player in connecting markets and enabling commerce worldwide. Read More

News & Press Releases

Via Benzinga · March 10, 2026

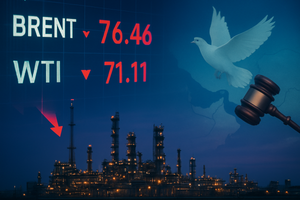

NEW YORK — Global energy markets experienced a seismic shift this week as crude oil prices plummeted from their recent geopolitical highs, providing a much-needed reprieve for a global economy that had been teetering on the edge of an energy-induced recession. Brent crude, the international benchmark, fell sharply below the psychologically

Via MarketMinute · March 10, 2026

The United States financial system is reeling under the weight of an unprecedented $170 billion refund obligation following a landmark Supreme Court ruling that invalidated tariffs collected under the International Emergency Economic Powers Act (IEEPA). The decision has triggered a massive legal and fiscal confrontation between the administration and thousands

Via MarketMinute · March 10, 2026

FedEx Corp. (NYSE:FDX) Shows Technical Strength and Bullish Setup for Potential Breakoutchartmill.com

Via Chartmill · March 5, 2026

Rising oil prices have weighed on United Parcel Service in recent days, but there’s reason for long-term investors to load up on UPS stock at current levels.

Via Barchart.com · March 10, 2026

LONDON — In a high-stakes effort to prevent a global economic "stagflation" trap, finance ministers from the Group of Seven (G7) nations issued a definitive joint statement on March 10, 2026, declaring their collective readiness to authorize a massive, coordinated release of strategic oil reserves. The move comes as the "Iran

Via MarketMinute · March 10, 2026

The American corporate landscape is bracing for an unprecedented liquidity surge following the landmark Supreme Court decision in Learning Resources, Inc. v. Trump. As of today, March 9, 2026, U.S. Customs and Border Protection (CBP) has begun the final stages of preparing a massive $166 billion refund program, returning

Via MarketMinute · March 9, 2026

As the first quarter of 2026 draws to a close, Wall Street finds itself locked in a high-stakes waiting game. The upcoming April U.S. Jobs Report, which will detail labor market performance for the month of March, has become the primary focal point for investors, policymakers, and economists alike.

Via MarketMinute · March 9, 2026

In a historic rebuke of executive overreach, the U.S. Supreme Court ruled on February 20, 2026, that the International Emergency Economic Powers Act (IEEPA) does not grant the President the authority to impose across-the-board tariffs. The 6-3 decision in Learning Resources, Inc. v. Trump has sent shockwaves through the

Via MarketMinute · March 9, 2026

FedEx Corporation stock has outpaced the Dow over the past year, while analysts remain moderately bullish about its prospects.

Via Barchart.com · March 9, 2026

The question of "too late" may be the wrong one to ask.

Via The Motley Fool · March 8, 2026

The ghost of the 1970s has returned to haunt Wall Street this morning, as a devastating combination of a dismal February jobs report and a geopolitical oil shock sent shockwaves through global markets. Investors woke up on March 6, 2026, to a "worst-case scenario" landscape: West Texas Intermediate (WTI) crude

Via MarketMinute · March 6, 2026

NEW YORK — The U.S. economy has officially entered a "worst-case scenario" as of March 6, 2026, with the specter of stagflation—a paralyzing combination of stagnant growth and high inflation—sending shockwaves through global markets. This morning’s Department of Labor report revealed a stunning contraction in the workforce,

Via MarketMinute · March 6, 2026

FedEx (FDX) momentum hits 90.47 as court clears $133B tariff refund path. See why this stock is now in Benzinga Edge's top 10%.

Via Benzinga · March 6, 2026

In a week that has sent shockwaves through the American economy, retail gasoline prices have surged by a staggering 9%, the sharpest weekly increase in nearly four years. As of March 5, 2026, the national average for a gallon of regular unleaded has hit $3.25, up from just $2.

Via MarketMinute · March 5, 2026

Global energy markets were sent into a tailspin on March 5, 2026, as escalating military tensions in the Middle East sparked fears of a prolonged supply disruption. West Texas Intermediate (WTI) crude, the U.S. benchmark, surged a staggering 8.5% to settle at $81.01 per barrel, while the

Via MarketMinute · March 5, 2026

The global energy landscape shifted violently today, March 5, 2026, as Brent and WTI crude prices spiked toward the $80 mark, driven by a rapid escalation in military conflict between a U.S.-led coalition and Iran. Following days of mounting tension in the Persian Gulf, the markets reacted with

Via MarketMinute · March 5, 2026

WASHINGTON, D.C. — In a landmark decision that has sent shockwaves through global supply chains and the halls of K Street, the U.S. Supreme Court has dealt a significant blow to executive trade authority. As of today, March 5, 2026, the financial markets are reacting to a dual-pronged development:

Via MarketMinute · March 5, 2026

Emerald Coast Interview Consulting has expanded its pilot interview preparation services for 2026, offering one-on-one coaching, mock interviews, and airline-specific guidance that helps candidates secure positions at regional and major carriers.

Via Press Release Distribution Service · March 4, 2026

Yoblt is Redefining Latex Fashion for Everyday Expression

London - Yoblt, a contemporary American latex fashion brand dedicated to bridging alternative expression and accessible style, announces its commitment to making personalized latex wear a seamless part of daily life. Built on four core pillars—premium latex materials, free custom sizing, 20-day express delivery, and reliable global logistics—Yoblt offers a refined and approachable path for those looking to incorporate statement-making latex into their everyday wardrobe, with quality, fit, and convenience at the forefront.

Via AB Newswire · March 4, 2026

Dikis – The Art of Tailored Expression in Latex Fashion

London - Dikis, an American latex fashion brand rooted in personal expression and accessible design, announces its commitment to delivering truly individualized latex wear through four essential pillars: premium latex materials, free custom sizing, 20-day express delivery, and reliable global logistics. In a fashion landscape often limited by standard sizes and impersonal service, Dikis stands apart by ensuring every customer receives a garment crafted to their unique shape and style, delivered promptly across continents.

Via AB Newswire · March 3, 2026

LatexDress: Where Every Curve Tells a Story in Custom Latex Fashion

London - LatexDress, an innovative American latex fashion brand dedicated to transforming personal style into wearable art, proudly announces its commitment to accessible luxury through four foundational principles: premium latex materials, free custom sizing, 20-day express delivery, and trusted global logistics. In an industry where personal expression often meets practical limitations, LatexDress bridges the gap by offering garments that are meticulously crafted to individual measurements, delivered swiftly and reliably across the globe.

Via AB Newswire · March 3, 2026

Jopex – Every Wardrobe Deserves a Personalized Latex Statement

London - Jopex, an emerging American latex fashion brand with a focus on versatile and personalized design, proudly announces its commitment to delivering custom-fit latex apparel for everyday and expressive wear. Through four foundational pillars—premium latex materials, free custom sizing, 20-day express delivery, and dependable global logistics—Jopex ensures every customer receives garments tailored to their unique style and measurements, delivered promptly anywhere in the world.

Via AB Newswire · March 3, 2026

The global financial markets have entered a period of profound "legalized volatility" following the White House’s emergency invocation of Section 122 of the Trade Act of 1974. This move, triggered by a landmark Supreme Court ruling on February 20, 2026, has replaced previous executive-led trade actions with a 10%

Via MarketMinute · March 3, 2026

FedEx wants tariff refunds, but it also has its own strategic plan.

Via The Motley Fool · March 3, 2026