NYSE:EWJ Fund Quote

68.12

-0.44 (-0.64%)

iShares MSCI Japan Index Fund is a security that trades on the New York Stock Exchange

| Previous Close | 68.56 |

|---|---|

| Open | 67.83 |

| Day's Range | 67.51 - 68.41 |

| 52 Week Range | 60.62 - 73.24 |

| Volume | 3,745,236 |

| Market Cap | 135.70M |

| Dividend & Yield | 1.018 (1.49%) |

| 1 Month Average Volume | 5,267,461 |

News & Press Releases

The Bank of Japan estimates its neutral rate at between 1.0% and 2.5%.

Via Talk Markets · April 1, 2025

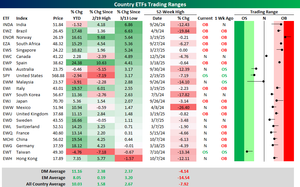

Whereas the US is down low single digits this year, most other countries have in that time risen well into the double digits.

Via Talk Markets · March 27, 2025

Known as the Oracle of Omaha, Warren Buffett has caught market attention with Berkshire Hathaway’s rising cash stockpile and increased positions in key stocks.

Via MarketBeat · March 25, 2025

Inflation figures for Tokyo and Singapore will be in focus over the coming week, alongside a decision on Chinese medium-term lending facility rates.

Via Talk Markets · March 21, 2025

U.S. economic weakness continues to show up outside the country as much as inside (last payroll estimate notwithstanding).

Via Talk Markets · October 8, 2024

Warren Buffett approves of Japan's top trading houses, with Berkshire Hathaway now holding a $23.5 billion stake. ETFs like EWJ and DXJ are gaining.

Via Benzinga · February 25, 2025

Japan's month-end data, especially Tokyo’s inflation, will be closely watched by Bank of Japan officials.

Via Talk Markets · February 21, 2025

Japan's consumer inflation rises to 3.2%, sparking expectations of BOJ hiking rates. ETFs EWJ, BBJP, and DXJ may see mixed outcomes as inflation and bond yields increase.

Via Benzinga · February 21, 2025

After two straight calendar years of red-hot performance, American shares are experiencing a run of muted results on the global stage.

Via Talk Markets · February 11, 2025

At the end of January, Japan will publish its month-end data, with the Bank of Japan paying particular attention to service prices.

Via Talk Markets · January 23, 2025

Central bank meetings in Japan, Indonesia, and the Philippines will take center stage over the week ahead in Asia, alongside an incoming data dump from China and CPI readings across the region.

Via Talk Markets · December 13, 2024

The BoJ trade is gaining momentum as investors bet on a weaker yen and higher Japanese equities. Trump's policies and BoJ decisions will impact its success.

Via Benzinga · December 12, 2024

We look at what’s in store in the region next week, including China’s Central Economic Work Conference, Australia’s cash target rate, India’s inflation data and the Japanese Tankan business survey.

Via Talk Markets · December 5, 2024

South Korea (EWY) is by far the worst performer today and it is also now the only one trading at a 52-week low too.

Via Talk Markets · December 3, 2024

PMIs and CPI data will be in focus across the region over the coming week, alongside a rate decision in India and Japan’s labor cash earnings.

Via Talk Markets · November 28, 2024

Looking at today’s long-term monthly chart, it appears that it is worthwhile to keep a close eye on the Nikkei index.

Via Talk Markets · November 21, 2024

The Bank of Korea meets next week to decide on rates. Meanwhile, we’ll get CPI readings from Singapore and Australia.

Via Talk Markets · November 21, 2024

China’s loan prime rates, Taiwan’s export orders and unemployment orders, Japan’s headline inflation data, and Indonesia’s BI rate will be in focus throughout a quieter week across Asia.

Via Talk Markets · November 15, 2024

China’s data dump will be the key highlight to look out for in a quieter week ahead for APAC.

Via Talk Markets · November 7, 2024

The meeting of China’s National People’s Congress will be watched very closely by markets next week.

Via Talk Markets · November 1, 2024

Monthly industrial production results have been mixed but generally indicate a modest recovery in third-quarter GDP.

Via Talk Markets · October 31, 2024

The BoJ’s interest rate meeting on Thursday is a highlight for next week.

Via Talk Markets · October 25, 2024

Tokyo inflation data may be the data point to watch in the coming week, as it could meaningfully influence the timing of the Bank of Japan’s next move.

Via Talk Markets · October 18, 2024

Shigeru Ishiba’s selection as prime minister sparked some consternation in markets due to uncertainties around his policy objectives.

Via Talk Markets · October 8, 2024

The major Asian markets diverged on Monday as country-specific catalysts drove the averages to either side of the unchanged line. Amid the development, the U.S. index futures remained unchanged, with a slight positive bias.

Via Benzinga · September 30, 2024