Albemarle Corporation Common Stock (ALB)

166.54

-3.03 (-1.79%)

NYSE · Last Trade: Mar 10th, 7:19 PM EDT

Via MarketBeat · March 7, 2026

Get insights into the top movers in the S&P500 index of Wednesday's pre-market session.chartmill.com

Via Chartmill · March 4, 2026

Which S&P500 stocks are moving on Tuesday?chartmill.com

Via Chartmill · March 3, 2026

Exploring the top movers within the S&P500 index during today's session.chartmill.com

Via Chartmill · March 3, 2026

These S&P500 stocks are gapping in today's sessionchartmill.com

Via Chartmill · March 3, 2026

Get insights into the top movers in the S&P500 index of Tuesday's pre-market session.chartmill.com

Via Chartmill · March 3, 2026

As of late February 2026, the global materials sector is witnessing a dramatic resurgence, spearheaded by a powerhouse performance from Albemarle (NYSE: ALB). After two years of grueling price compression and market skepticism, the world’s largest lithium producer has seen its stock price climb to a 52-week high of

Via MarketMinute · February 27, 2026

CHARLOTTE, N.C. – February 27, 2026 – The lithium market, long dormant following a bruising two-year downturn, has roared back to life this month with a ferocity that has caught many analysts off guard. Lithium carbonate prices have skyrocketed by 68% in the last 30 days alone, marking a definitive end

Via MarketMinute · February 27, 2026

Uncover the latest developments among S&P500 stocks in today's session.chartmill.com

Via Chartmill · February 26, 2026

Discover which S&P500 stocks are making waves on Thursday.chartmill.com

Via Chartmill · February 26, 2026

In a move that has sent shockwaves through the global electric vehicle (EV) supply chain, the Zimbabwean government announced an immediate and total ban on the export of all raw minerals and lithium concentrates on February 25, 2026. This sudden policy shift, an aggressive acceleration of the country’s "Value

Via MarketMinute · February 26, 2026

An improving lithium demand environment is positioning Albemarle for growth in 2026.

Via The Motley Fool · February 25, 2026

Stay informed with the top movers within the S&P500 index on Wednesday.chartmill.com

Via Chartmill · February 25, 2026

Top S&P500 movers in Wednesday's sessionchartmill.com

Via Chartmill · February 25, 2026

The era of broad-based commodity cycles, where a rising tide of global growth or a falling dollar lifted all boats, appears to have reached a definitive end. According to the February 2026 commodity price forecast released this week by Oxford Economics, the market is entering a phase of "widening dispersion.

Via MarketMinute · February 25, 2026

These S&P500 stocks are moving in today's pre-market sessionchartmill.com

Via Chartmill · February 25, 2026

Zimbabwean Mines Minister Polite Kambamura said that the export ban is effective immediately until further notice.

Via Stocktwits · February 25, 2026

Uncover the latest developments among S&P500 stocks in today's session.chartmill.com

Via Chartmill · February 24, 2026

Top S&P500 movers in Tuesday's sessionchartmill.com

Via Chartmill · February 24, 2026

Which S&P500 stocks are moving on Monday?chartmill.com

Via Chartmill · February 23, 2026

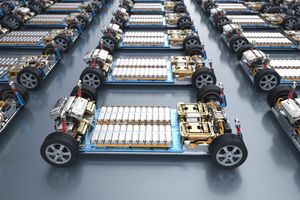

Copper and lithium are both commodities tied to powerful economic trends like electrification, renewable energy, and data center investment, and these stocks are the best way to invest in them.

Via The Motley Fool · February 21, 2026

In a move that has sent shockwaves through the global battery metals sector, Albemarle Corporation (NYSE:ALB) officially announced on February 11, 2026, that it will idle the remaining operations at its flagship Kemerton lithium hydroxide plant in Western Australia. This decision marks the final chapter in a multi-year restructuring

Via MarketMinute · February 16, 2026

MarketBeat Week in Review – 02/09 - 02/13marketbeat.com

Via MarketBeat · February 14, 2026

FEBRUARY 13, 2026 — The lithium market, which spent much of 2024 and 2025 in a punishing "glut-induced" slumber, has woken up with a vengeance this month. A perfect storm of geopolitical maneuvering, aggressive new U.S. industrial policy, and a massive pull-forward in Chinese demand has sent lithium carbonate futures

Via MarketMinute · February 13, 2026

Via MarketBeat · February 12, 2026