Microchip Technology (MCHP)

75.22

+1.69 (2.30%)

NASDAQ · Last Trade: Jan 12th, 2:48 AM EST

Expensive stocks often command premium valuations because the market thinks their business models are exceptional.

However, the downside is that high expectations are already baked into their prices, leaving little room for error if they stumble even slightly.

Via StockStory · January 8, 2026

GARDEN CITY, NY — In a resounding signal of the intensifying demand for advanced aerospace and defense infrastructure, Frequency Electronics, Inc. (NASDAQ: FEIM) saw its shares surge to a new 52-week high of $59.38 on January 8, 2026. The rally, which has outpaced several of its mid-cap peers in the

Via MarketMinute · January 8, 2026

A number of stocks jumped in the afternoon session after a broader market rally drove investor optimism in artificial intelligence and big tech stocks. The S&P 500, Dow Jones, and Nasdaq all pushed higher, approaching record levels set late last year. Much of the positive momentum was linked to the technology sector, with a particular focus on companies advancing artificial intelligence, a key theme at the annual CES trade show in Las Vegas. This continued a powerful trend from 2025, when AI-related developments were a primary catalyst for the market's bull run. The upbeat sentiment was further supported by hopes for easier monetary policy from the Federal Reserve following a weaker-than-expected US Services PMI reading.

Via StockStory · January 6, 2026

Microchip pre-announced a strong beat for the December quarter.

Via The Motley Fool · January 6, 2026

Uncover the latest developments among S&P500 stocks in today's session.chartmill.com

Via Chartmill · January 6, 2026

These S&P500 stocks are moving in today's sessionchartmill.com

Via Chartmill · January 6, 2026

Tuesday's pre-market session: top gainers and losers in the S&P500 indexchartmill.com

Via Chartmill · January 6, 2026

Since July 2025, Microchip Technology has been in a holding pattern, posting a small loss of 2.9% while floating around $69.41. The stock also fell short of the S&P 500’s 10.1% gain during that period.

Via StockStory · January 5, 2026

As the calendar turns to 2026, the semiconductor landscape is witnessing a massive tectonic shift in capital allocation. Texas Instruments (NASDAQ:TXN), the stalwart of the analog chip world, has emerged as the clear favorite for institutional heavyweights. Following a turbulent two-year period of aggressive infrastructure spending, recent filings reveal

Via MarketMinute · January 1, 2026

The stocks featured in this article are seeing some big returns.

Over the past month, they’ve outpaced the market due to some combination of positive news, upbeat results, or supportive macro developments. As such, investors are taking notice and bidding up shares.

Via StockStory · December 23, 2025

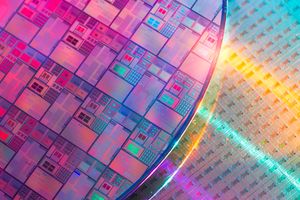

In an era defined by hyper-connectivity and unprecedented digital transformation, the semiconductor industry stands as the foundational pillar of global technology. From the smartphones in our pockets to the advanced AI systems driving innovation, every digital interaction relies on the intricate dance of electrons within these tiny chips. Yet, this critical industry, responsible for the [...]

Via TokenRing AI · December 17, 2025

Shares of analog chipmaker Microchip Technology (NASDAQ:MCHP)

fell 2.2% in the afternoon session after a broader market downturn and specific weakness in the semiconductor industry overshadowed positive analyst ratings.

Via StockStory · December 16, 2025

Large-cap stocks have the power to shape entire industries thanks to their size and widespread influence.

With such vast footprints, however, finding new areas for growth is much harder than for smaller, more agile players.

Via StockStory · December 15, 2025

As of December 9, 2025, Tesla's (NASDAQ: TSLA) stock has witnessed a remarkable rally, reflecting a surge in investor confidence that extends far beyond its electric vehicle (EV) dominance. This powerful market performance is largely fueled by the company's ambitious ventures into artificial intelligence (AI), robotics, and energy storage, positioning

Via MarketMinute · December 9, 2025

Via MarketBeat · December 9, 2025

The S&P 500 (^GSPC) is often seen as a benchmark for strong businesses, but that doesn’t mean every stock is worth owning.

Some companies face significant challenges, whether it’s stagnating growth, heavy debt, or disruptive new competitors.

Via StockStory · December 7, 2025

The end of the earnings season is always a good time to take a step back and see who shined (and who not so much). Let’s take a look at how analog semiconductors stocks fared in Q3, starting with Microchip Technology (NASDAQ:MCHP).

Via StockStory · December 5, 2025

Check out the companies making headlines yesterday:

Via StockStory · December 4, 2025

A surprise drop in private-sector jobs pushed rate-cut expectations even higher and lifted stocks, even as fresh doubts about enterprise AI spending knocked Microsoft lower. Under the surface, chipmakers, retailers, and high-growth software names showed just how narrow and rotational this market still is.

Via Chartmill · December 4, 2025

December 3, 2025 - Microchip Technology (NASDAQ: MCHP) witnessed a significant surge in its stock price today, following the release of exceptionally strong guidance that has sent positive ripples through the semiconductor industry. The robust outlook, detailed in the company's latest announcement, points to sustained demand and healthy operational performance,

Via MarketMinute · December 3, 2025

Shares of analog chipmaker Microchip Technology (NASDAQ:MCHP)

jumped 11% in the afternoon session after the company raised its financial guidance for its third fiscal quarter, citing stronger-than-expected business performance, bookings, and backlog. Microchip now expected its net sales and earnings per share to be at the high end of its previously provided range. This revised outlook represented an approximate 12% year-over-year growth in revenue. The company also anticipated non-GAAP earnings per share to be about $0.40, surpassing prior estimates. The CEO stated that business was performing better than expected with booking activity remaining strong. In addition to the upgraded forecast, the company also announced the launch of new energy-efficient power monitors designed to reduce power consumption by 50% in portable devices.

Via StockStory · December 3, 2025

Microchip updated guidance at an industry conference today, saying the quarter is going better-than-expected.

Via The Motley Fool · December 3, 2025

Wondering what's happening in today's session for the S&P500 index? Stay informed with the top movers within the S&P500 index on Wednesday.

Via Chartmill · December 3, 2025

Let's have a look at what is happening on the US markets on Wednesday. Below you can find the S&P500 stocks with an unusual volume in today's session.

Via Chartmill · December 3, 2025

Stay updated with the movements of the S&P500 index in the middle of the day on Wednesday. Discover which stocks are leading as top gainers and losers in today's session.

Via Chartmill · December 3, 2025