Intel Corp (INTC)

45.55

+0.00 (0.00%)

NASDAQ · Last Trade: Jan 12th, 8:38 AM EST

Published: January 2, 2026 Introduction As we enter 2026, NVIDIA Corporation (NASDAQ: NVDA) remains the gravitational center of the global technology landscape. No longer viewed simply as a "chipmaker," NVIDIA has successfully rebranded itself as the full-stack infrastructure provider for what CEO Jensen Huang calls the "Fourth Industrial Revolution." With a market capitalization hovering near [...]

Via PredictStreet · January 2, 2026

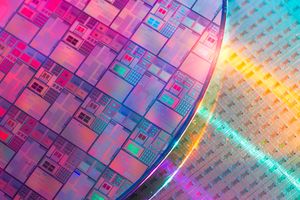

As of January 2, 2026, the global semiconductor landscape remains inextricably tied to a single company based in Veldhoven, Netherlands. ASML Holding N.V. (NASDAQ: ASML), the world’s sole provider of extreme ultraviolet (EUV) lithography systems, is back in the spotlight following a major analyst upgrade that sent shares surging 5% in early trading today. The [...]

Via PredictStreet · January 2, 2026

Intel Shares Surge On Trump Praise — Retail Anticipates ‘Big News’stocktwits.com

Via Stocktwits · January 9, 2026

Nvidia has been the star of the artificial intelligence show for three years, and its stellar performance doesn't appear to be coming to an end.

Via The Motley Fool · January 12, 2026

What does the new year bring to investors?

Via The Motley Fool · January 12, 2026

March S&P 500 E-Mini futures (ESH26) are down -0.64%, and March Nasdaq 100 E-Mini futures (NQH26) are down -0.82% this morning as sentiment took a hit amid escalating tensions between the Trump administration and the Federal Reserve.

Via Barchart.com · January 12, 2026

Chips + Nuclear Power = Fresh Records on Wall Streetchartmill.com

Via Chartmill · January 12, 2026

Large-cap stocks usually command their industries because they have the scale to drive market trends.

The flip side though is that their sheer size can limit growth as expanding further becomes an increasingly challenging task.

Via StockStory · January 11, 2026

Via Benzinga · January 12, 2026

Nvidia, AMD, Intel, and TSMC dominate CES 2026 with AI chips, open-source autonomy, and next-gen platforms as global demand accelerates across data centers and vehicles. Markets swing as Maduro's capture sparks drone stock rallies, AI regulation tightens, mega PAC funding surges, and tech earnings, chips, and defense dominate headlines.

Via Benzinga · January 11, 2026

As of January 1, 2026, Apple Inc. (NASDAQ: AAPL) remains the quintessential bellwether of the global technology sector. With a market capitalization fluctuating between $3 trillion and $4 trillion over the past year, the Cupertino-based giant has transitioned from being a mere hardware manufacturer to a pervasive ecosystem of high-margin services and integrated artificial intelligence. [...]

Via PredictStreet · January 1, 2026

As of January 1, 2026, Intel Corporation (NASDAQ: INTC) stands at the most critical juncture in its 58-year history. Once the undisputed king of the semiconductor world, the Silicon Valley giant spent the early 2020s in a high-stakes battle for relevance, nearly succumbing to manufacturing delays and the rise of fabless competitors. However, following a [...]

Via PredictStreet · January 1, 2026

As we enter 2026, NVIDIA Corporation (NASDAQ: NVDA) stands not merely as a semiconductor designer, but as the undisputed architect of the global "Intelligence Age." Following a two-year period of unprecedented hyper-growth, NVIDIA’s influence now stretches across every sector of the modern economy, from autonomous vehicles to the sovereign AI clouds of world governments. Today, [...]

Via PredictStreet · January 1, 2026

Demand for semiconductors is soaring due to the rising effectiveness of artificial intelligence.

Via The Motley Fool · January 10, 2026

The artificial intelligence ASICs market is heating up, and it's time to buy some top stocks in this field in January.

Via The Motley Fool · January 10, 2026

Intel's stock has surged on fresh political support and product momentum, as its turnaround appears to be gaining traction.

Via The Motley Fool · January 10, 2026

INTC shares have been in a sharp uptrend over the past six months – a rally that has “doubled” the value of the Trump administration’s stake in the chip manufacturer.

Via Talk Markets · January 9, 2026

President Trump wants to bring "leading-edge chip manufacturing back to America."

Via The Motley Fool · January 9, 2026

On Jan. 9, 2026, investors weighed Trump’s “national champion” nod alongside Intel’s 1.8 nanometer CPU momentum.

Via The Motley Fool · January 9, 2026

The first trading week of 2026 has delivered a complex narrative for the technology sector, defined by a stark contrast between groundbreaking innovation and a massive institutional shift in capital. As the world gathered for the Consumer Electronics Show (CES) in Las Vegas, Nvidia Corp. (NASDAQ: NVDA) once again seized

Via MarketMinute · January 9, 2026

Positive jobs data and high-profile political backing for Intel pushed major U.S. indexes toward new highs, today, Jan. 9, 2026.

Via The Motley Fool · January 9, 2026

Shares of Intel (NASDAQ: INTC) surged 10.5% today, closing at a multi-year high of $44.99, as investors reacted to a landmark meeting between CEO Lip-Bu Tan and President Donald Trump. The high-stakes summit, held yesterday at the White House, appears to have cemented Intel’s status as the

Via MarketMinute · January 9, 2026

As we move into early January 2026, the technology sector is standing at the precipice of a massive structural shift. While the previous two years were defined by a frantic "land grab" for specialized chips and data center capacity, the market is now entering a high-conviction "Utility Phase." This transition

Via MarketMinute · January 9, 2026

As of January 2026, the global artificial intelligence landscape has shifted from a race between private tech giants to a high-stakes geopolitical competition for "Sovereign AI." No longer content to "rent" intelligence from Silicon Valley, nations are aggressively building their own end-to-end AI stacks—encompassing domestic hardware, localized data centers, and culturally specific foundation models. This [...]

Via TokenRing AI · January 9, 2026

The era of "bigger is better" in artificial intelligence has officially met its match. As of early 2026, the tech industry has pivoted from the pursuit of trillion-parameter cloud giants toward a more intimate, efficient, and private frontier: the "Great Compression." This shift is defined by the rise of Small Language Models (SLMs) and Edge [...]

Via TokenRing AI · January 9, 2026