First Solar (FSLR)

195.38

+0.00 (0.00%)

NASDAQ · Last Trade: Mar 10th, 6:20 AM EDT

Detailed Quote

| Previous Close | 195.38 |

|---|---|

| Open | - |

| Bid | 195.00 |

| Ask | 197.97 |

| Day's Range | N/A - N/A |

| 52 Week Range | 116.56 - 285.99 |

| Volume | 1,260 |

| Market Cap | 20.77B |

| PE Ratio (TTM) | 13.75 |

| EPS (TTM) | 14.2 |

| Dividend & Yield | N/A (N/A) |

| 1 Month Average Volume | 2,792,308 |

Chart

About First Solar (FSLR)

First Solar is a prominent player in the renewable energy sector, specializing in the design, manufacturing, and deployment of solar photovoltaic (PV) modules. The company is dedicated to providing clean, sustainable energy solutions by producing advanced thin-film solar technology, which offers high performance and enhanced efficiency in capturing sunlight. In addition to manufacturing solar panels, First Solar is involved in developing large-scale solar power plants, helping to accelerate the transition towards a more sustainable energy future. Through its commitment to innovation and environmental stewardship, the company plays a critical role in advancing the adoption of solar energy globally. Read More

News & Press Releases

In a dramatic escalation of the "Energy Dominance 2.0" agenda, the Trump administration’s December 2025 decision to suspend major offshore wind leases has run into a formidable wall: the U.S. federal court system. As of March 9, 2026, work has resumed on several multi-billion dollar projects, including

Via MarketMinute · March 9, 2026

Today’s Date: March 6, 2026 Introduction In the volatile world of renewable energy, few names command the same level of institutional respect and strategic intrigue as First Solar (NASDAQ: FSLR). Long regarded as a "policy play" due to its heavy reliance on domestic manufacturing incentives, the company underwent a radical re-rating in mid-2024 that forever [...]

Via Finterra · March 6, 2026

These S&P500 stocks have an unusual volume in today's sessionchartmill.com

Via Chartmill · February 25, 2026

First Solar Inc (NASDAQ:FSLR) Stock Plummets After Q4 Earnings Miss and Weak 2026 Guidancechartmill.com

Via Chartmill · February 24, 2026

Which S&P500 stocks are moving after the closing bell on Tuesday?chartmill.com

Via Chartmill · February 24, 2026

NEW YORK, March 03, 2026 (GLOBE NEWSWIRE) -- Pomerantz LLP is investigating claims on behalf of investors of First Solar, Inc. (“First Solar” or the “Company”) (NASDAQ: FSLR). Such investors are advised to contact Danielle Peyton at newaction@pomlaw.com or 646-581-9980, ext. 7980.

By Pomerantz LLP · Via GlobeNewswire · March 3, 2026

First Solar's earnings are dominated by subsidies, which make the company vulnerable.

Via The Motley Fool · March 2, 2026

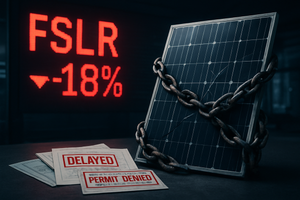

The domestic renewable energy sector was sent into a tailspin this past week as First Solar (NASDAQ: FSLR) issued a surprisingly conservative financial outlook for 2026, triggering a massive 18% sell-off in its shares. The Tempe, Arizona-based manufacturer, long considered the crown jewel of American solar production, stunned investors by

Via MarketMinute · March 2, 2026

Uncover the latest developments among S&P500 stocks in today's session.chartmill.com

Via Chartmill · February 26, 2026

On February 26, 2026, the renewable energy sector was jolted by a sharp correction in the valuation of its domestic champion. First Solar, Inc. (NASDAQ: FSLR), the largest solar manufacturer in the Western Hemisphere, saw its shares plummet 13.6% in a single trading session. The catalyst was not a failure of past performance—indeed, the company [...]

Via Finterra · February 26, 2026

As of February 26, 2026, the solar energy landscape is grappling with a paradox of record-breaking installations and severe corporate guidance shifts. At the center of this storm is First Solar, Inc. (NASDAQ: FSLR), the largest solar manufacturer in the Western Hemisphere. Long considered the "darling" of the U.S. renewable sector due to its unique [...]

Via Finterra · February 26, 2026

In a historic trading session that has sent shockwaves through global commodity markets, Comex silver futures settled nearly 4% higher today, February 25, 2026, closing at a staggering $90.24 per ounce. The breach of the $90 psychological resistance mark represents a watershed moment for the "devil's metal," which has

Via MarketMinute · February 25, 2026

The solar energy landscape faced a chilling reality check on February 25, 2026, as shares of First Solar (NASDAQ:FSLR) plummeted over 18% following an earnings report that painted a surprisingly cautious picture of the year ahead. Despite reporting record sales for 2025, the thin-film solar leader issued a 2026

Via MarketMinute · February 25, 2026

Stay informed with the top movers within the S&P500 index on Wednesday.chartmill.com

Via Chartmill · February 25, 2026

Shares of solar panel manufacturer First Solar (NASDAQ:FSLR)

fell 15% in the morning session after the company reported fourth-quarter earnings per share (EPS) that missed analyst expectations and issued a weaker-than-expected revenue forecast for 2026.

Via StockStory · February 25, 2026

Top S&P500 movers in Wednesday's sessionchartmill.com

Via Chartmill · February 25, 2026

First Solar is growing capacity, but demand needs to follow.

Via The Motley Fool · February 25, 2026

February 25, 2026 — The silver market has entered a transformative era, cementing its status as the "indispensable metal" of the 2020s. After a period of historic volatility that saw prices touch triple digits before a sharp correction, silver has successfully reclaimed the $80 per ounce threshold this month. This price

Via MarketMinute · February 25, 2026

The global financial landscape shifted dramatically on February 25, 2026, as gold and silver prices surged in response to a volatile cocktail of aggressive trade policy and escalating military tensions in the Middle East. Following a combative State of the Union address by President Trump and a landmark Supreme Court

Via MarketMinute · February 25, 2026

What's going on in today's session: S&P500 gap up and gap down stockschartmill.com

Via Chartmill · February 25, 2026

These S&P500 stocks are moving in today's pre-market sessionchartmill.com

Via Chartmill · February 25, 2026

Which stocks are moving before the opening bell on Wednesday?chartmill.com

Via Chartmill · February 25, 2026

First Solar’s full-year revenue came below Wall Street expectations and a quarterly profit miss has raised investor concerns regarding cost pressure due to tariffs.

Via Stocktwits · February 25, 2026

First Solar (FSLR) Q4 2025 Earnings Transcript

Via The Motley Fool · February 24, 2026

Solar panel manufacturer First Solar (NASDAQ:FSLR) beat Wall Street’s revenue expectations in Q4 CY2025, with sales up 11.1% year on year to $1.68 billion. On the other hand, the company’s full-year revenue guidance of $5.05 billion at the midpoint came in 17.4% below analysts’ estimates. Its GAAP profit of $4.84 per share was 6.3% below analysts’ consensus estimates.

Via StockStory · February 24, 2026