GameStop has been treading water for the past six months, recording a small return of 2.2% while holding steady at $28.42.

Is now the time to buy GameStop, or should you be careful about including it in your portfolio? Get the full stock story straight from our expert analysts, it’s free.

Why Do We Think GameStop Will Underperform?

We don't have much confidence in GameStop. Here are three reasons why GME doesn't excite us and a stock we'd rather own.

1. Revenue Spiraling Downwards

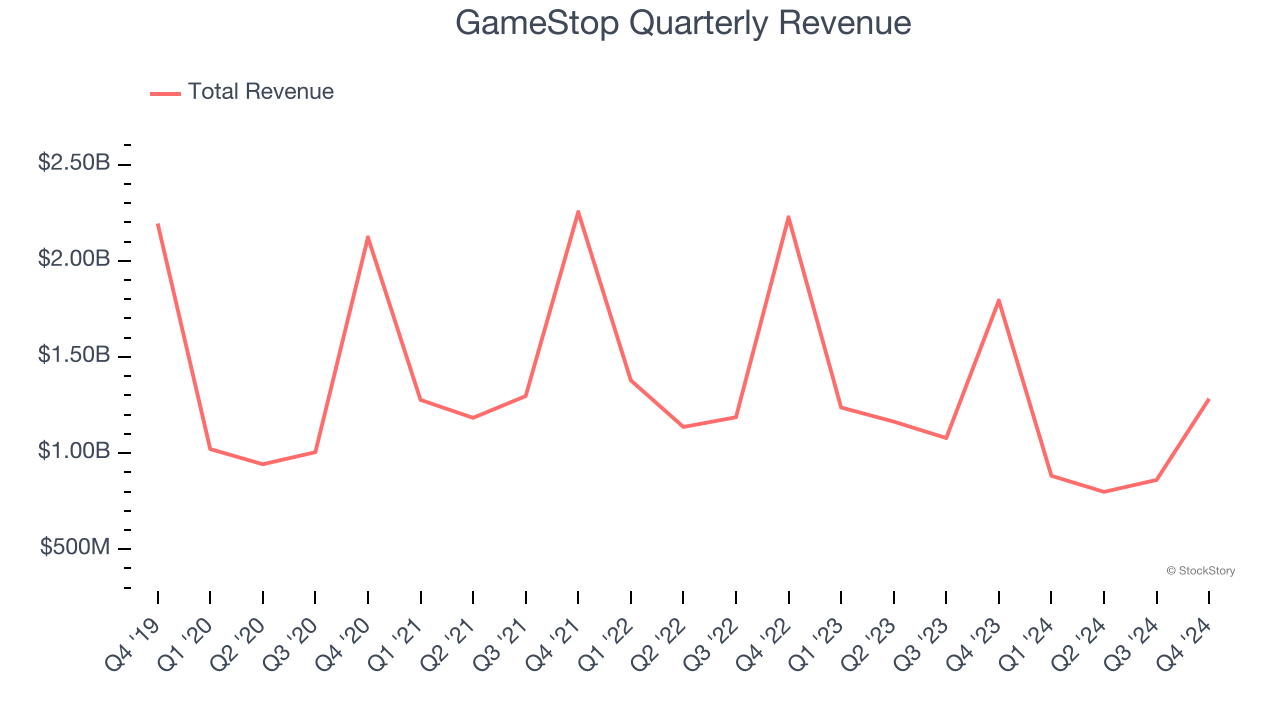

Reviewing a company’s long-term sales performance reveals insights into its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. GameStop’s demand was weak over the last five years as its sales fell at a 10% annual rate. This was below our standards and is a sign of poor business quality.

2. Breakeven Operating Raises Questions

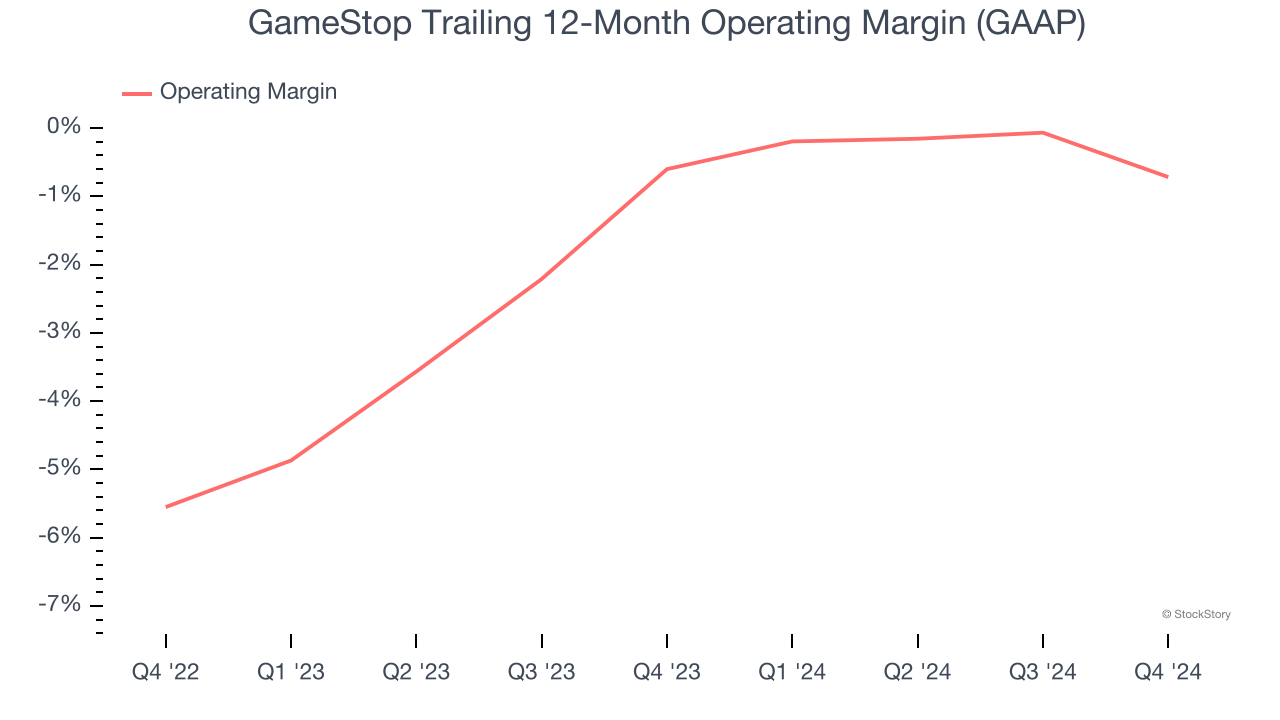

Operating margin is a key profitability metric because it accounts for all expenses necessary to run a store, including wages, inventory, rent, advertising, and other administrative costs.

GameStop was roughly breakeven when averaging the last two years of quarterly operating profits, one of the worst outcomes in the consumer retail sector. This result isn’t too surprising given its low gross margin as a starting point.

3. Previous Growth Initiatives Have Lost Money

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

GameStop’s five-year average ROIC was negative 22.9%, meaning management lost money while trying to expand the business. Its returns were among the worst in the consumer retail sector.

Final Judgment

GameStop falls short of our quality standards. That said, the stock currently trades at $28.42 per share (or a forward price-to-sales ratio of 3.4×). The market typically values companies like GameStop based on their anticipated profits for the next 12 months, but it expects the business to lose money. We also think the upside isn’t great compared to the potential downside here - there are more exciting stocks to buy. Let us point you toward one of our top software and edge computing picks.

Stocks We Like More Than GameStop

Market indices reached historic highs following Donald Trump’s presidential victory in November 2024, but the outlook for 2025 is clouded by new trade policies that could impact business confidence and growth.

While this has caused many investors to adopt a "fearful" wait-and-see approach, we’re leaning into our best ideas that can grow regardless of the political or macroeconomic climate. Take advantage of Mr. Market by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 176% over the last five years.

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.