XPO currently trades at $104.96 per share and has shown little upside over the past six months, posting a small loss of 2.4%.

Is now the time to buy XPO, or should you be careful about including it in your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free.

We're sitting this one out for now. Here are three reasons why XPO doesn't excite us and a stock we'd rather own.

Why Do We Think XPO Will Underperform?

Owning a mobile game simulating freight operations for the Tour de France, XPO (NYSE:XPO) is a transportation company specializing in expedited shipping services.

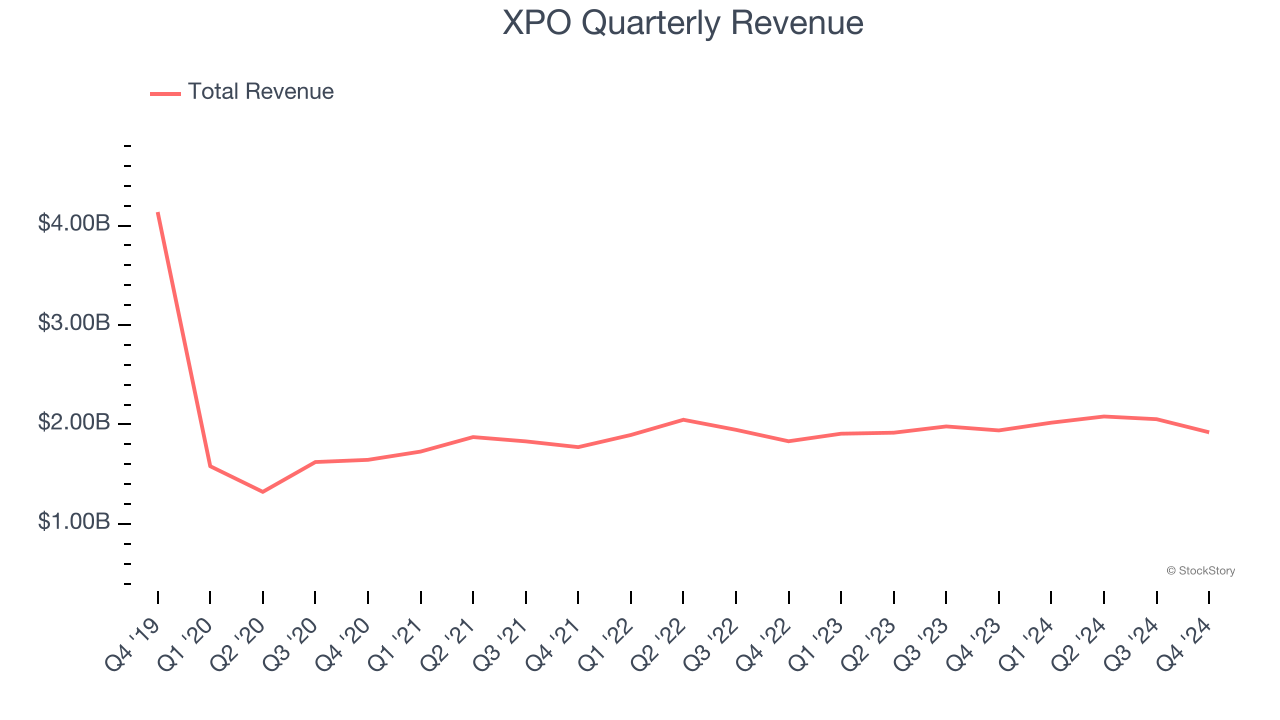

1. Revenue Spiraling Downwards

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. XPO struggled to consistently generate demand over the last five years as its sales dropped at a 13.5% annual rate. This was below our standards and is a sign of poor business quality.

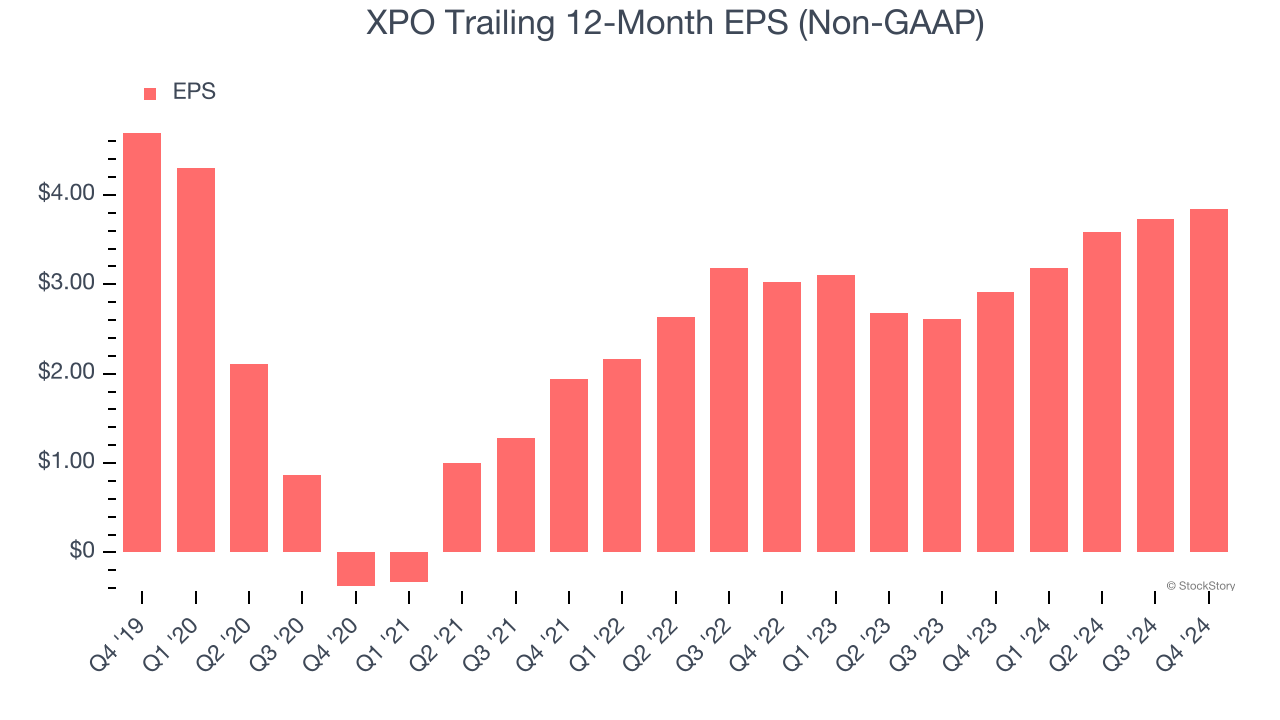

2. EPS Trending Down

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Sadly for XPO, its EPS and revenue declined by 3.9% and 13.5% annually over the last five years. We tend to steer our readers away from companies with falling revenue and EPS, where diminishing earnings could imply changing secular trends and preferences. If the tide turns unexpectedly, XPO’s low margin of safety could leave its stock price susceptible to large downswings.

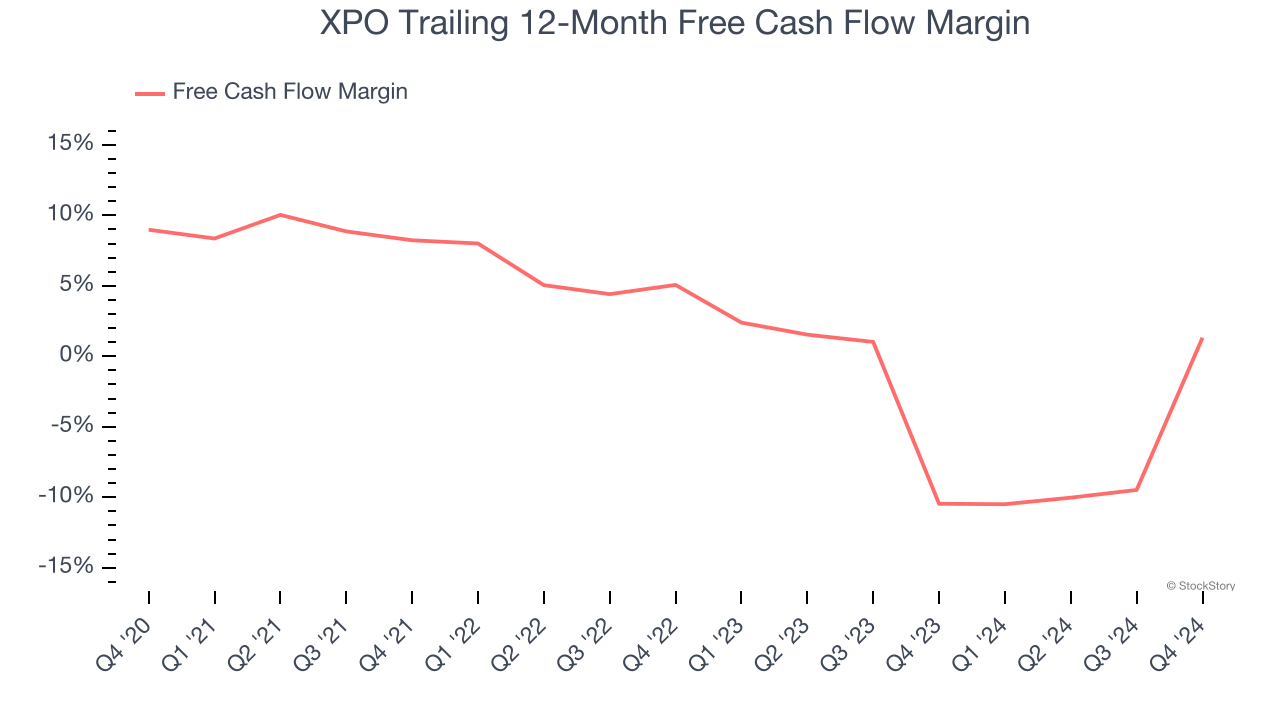

3. Free Cash Flow Margin Dropping

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

As you can see below, XPO’s margin dropped by 7.7 percentage points over the last five years. It may have ticked higher more recently, but shareholders are likely hoping for its margin to at least revert to its historical level. Almost any movement in the wrong direction is undesirable because of its already low cash conversion. If the longer-term trend returns, it could signal it’s becoming a more capital-intensive business. XPO’s free cash flow margin for the trailing 12 months was 1.3%.

Final Judgment

XPO doesn’t pass our quality test. That said, the stock currently trades at 25.7× forward price-to-earnings (or $104.96 per share). At this valuation, there’s a lot of good news priced in - you can find better investment opportunities elsewhere. Let us point you toward a safe-and-steady industrials business benefiting from an upgrade cycle.

Stocks We Would Buy Instead of XPO

The Trump trade may have passed, but rates are still dropping and inflation is still cooling. Opportunities are ripe for those ready to act - and we’re here to help you pick them.

Get started by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Sterling Infrastructure (+1,096% five-year return). Find your next big winner with StockStory today for free.