While the broader market has struggled with the S&P 500 down 1% since September 2024, Zillow has surged ahead as its stock price has climbed by 20.2% to $69.50 per share. This performance may have investors wondering how to approach the situation.

Is there a buying opportunity in Zillow, or does it present a risk to your portfolio? See what our analysts have to say in our full research report, it’s free.

We’re happy investors have made money, but we're cautious about Zillow. Here are three reasons why we avoid ZG and a stock we'd rather own.

Why Is Zillow Not Exciting?

Founded by Expedia co-founders Lloyd Frink and Rich Barton, Zillow (NASDAQ:ZG) is the leading U.S. online real estate marketplace.

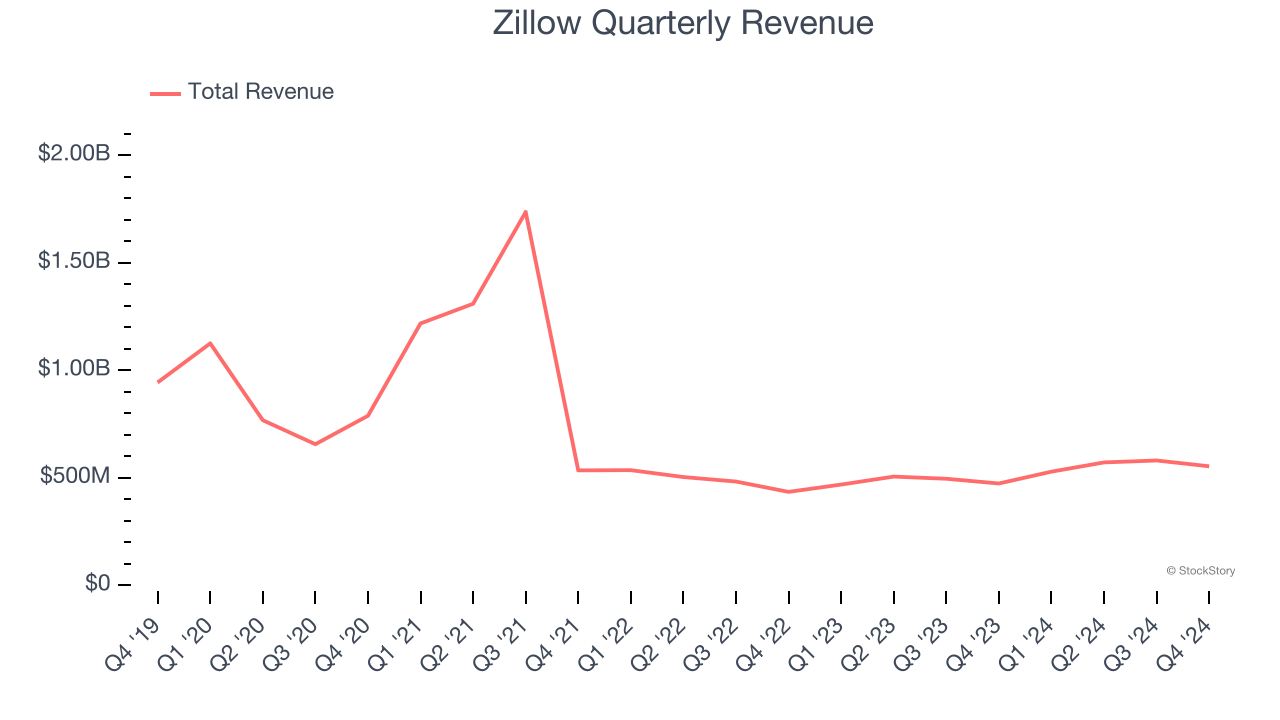

1. Revenue Spiraling Downwards

A company’s long-term performance is an indicator of its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Over the last five years, Zillow’s demand was weak and its revenue declined by 4% per year. This wasn’t a great result and signals it’s a lower quality business.

2. Operating Losses Sound the Alarms

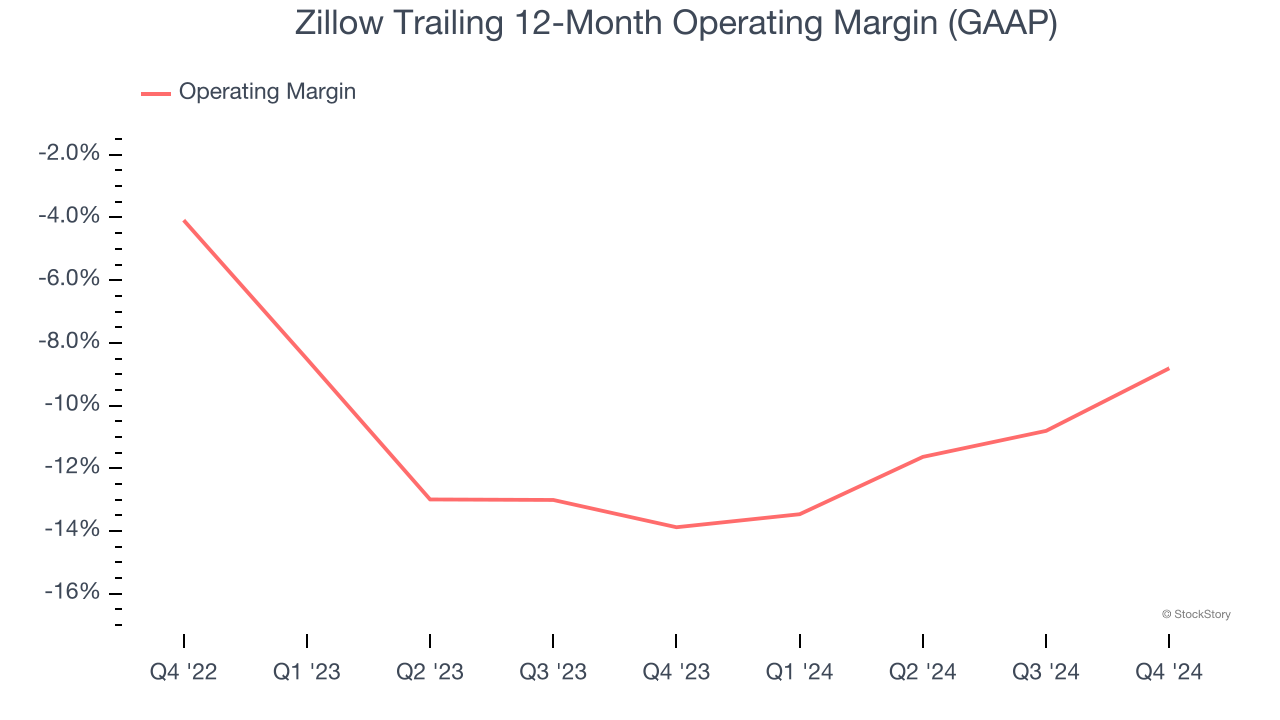

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Zillow’s operating margin has been trending up over the last 12 months, but it still averaged negative 11.2% over the last two years. This is due to its large expense base and inefficient cost structure.

3. Previous Growth Initiatives Have Lost Money

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Zillow’s five-year average ROIC was negative 4.6%, meaning management lost money while trying to expand the business. Its returns were among the worst in the consumer discretionary sector.

Final Judgment

Zillow isn’t a terrible business, but it doesn’t pass our bar. With its shares outperforming the market lately, the stock trades at 36.1× forward price-to-earnings (or $69.50 per share). This valuation tells us a lot of optimism is priced in - we think there are better stocks to buy right now. Let us point you toward one of our top digital advertising picks.

Stocks We Like More Than Zillow

The Trump trade may have passed, but rates are still dropping and inflation is still cooling. Opportunities are ripe for those ready to act - and we’re here to help you pick them.

Get started by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Comfort Systems (+751% five-year return). Find your next big winner with StockStory today for free.