Financial technology platform Intuit (NASDAQ:INTU) reported Q3 CY2025 results topping the market’s revenue expectations, with sales up 18.3% year on year to $3.89 billion. Guidance for next quarter’s revenue was better than expected at $4.53 billion at the midpoint, 1.3% above analysts’ estimates. Its non-GAAP profit of $3.34 per share was 8.1% above analysts’ consensus estimates.

Is now the time to buy Intuit? Find out by accessing our full research report, it’s free for active Edge members.

Intuit (INTU) Q3 CY2025 Highlights:

- Revenue: $3.89 billion vs analyst estimates of $3.77 billion (18.3% year-on-year growth, 3.2% beat)

- Adjusted EPS: $3.34 vs analyst estimates of $3.09 (8.1% beat)

- Adjusted Operating Income: $1.26 billion vs analyst estimates of $1.17 billion (32.4% margin, 7.5% beat)

- The company reconfirmed its revenue guidance for the full year of $21.09 billion at the midpoint

- Management reiterated its full-year Adjusted EPS guidance of $23.08 at the midpoint

- Operating Margin: 13.7%, up from 8.3% in the same quarter last year

- Free Cash Flow Margin: 15.4%, up from 9.3% in the previous quarter

- Billings: $3.91 billion at quarter end, up 18.4% year on year

- Market Capitalization: $181.4 billion

Company Overview

Originally named after its founding product "Intuitive for the first-time user," Intuit (NASDAQ:INTU) provides financial management software and services including TurboTax, QuickBooks, Credit Karma, and Mailchimp to help consumers and small businesses manage their finances.

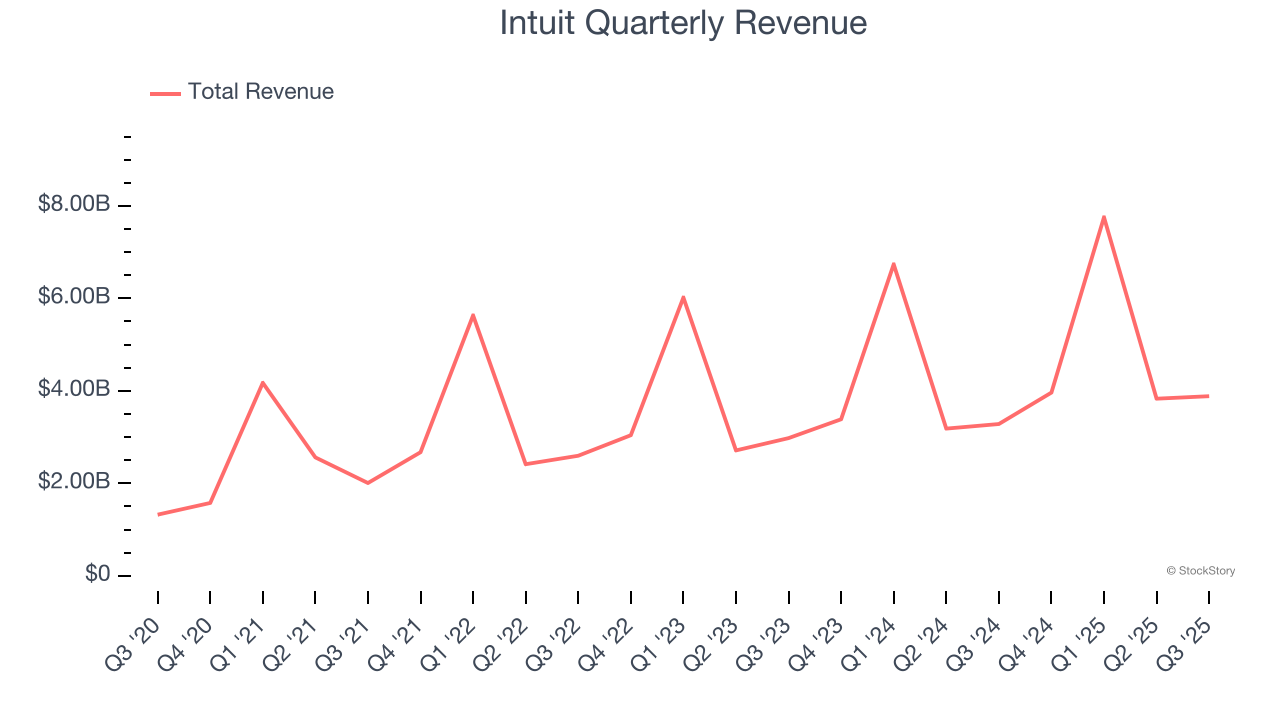

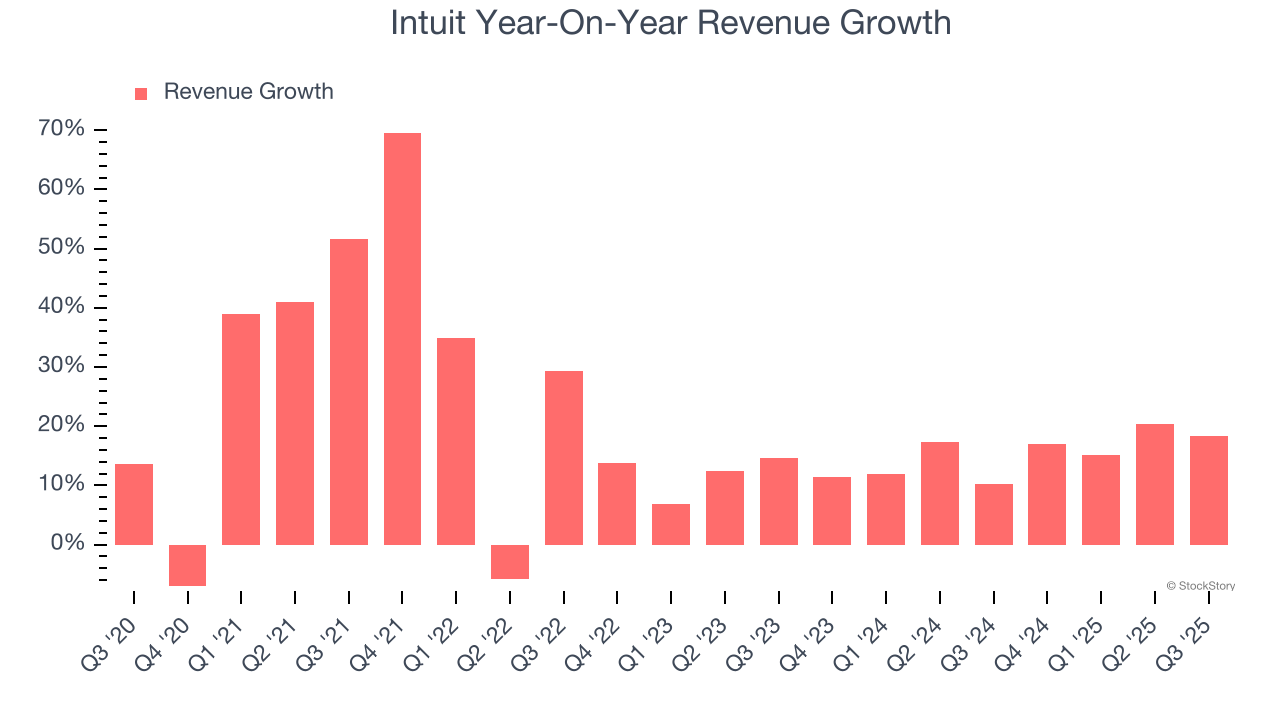

Revenue Growth

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Thankfully, Intuit’s 19.9% annualized revenue growth over the last five years was decent. Its growth was slightly above the average software company and shows its offerings resonate with customers.

Long-term growth is the most important, but within software, a half-decade historical view may miss new innovations or demand cycles. Intuit’s recent performance shows its demand has slowed as its annualized revenue growth of 14.8% over the last two years was below its five-year trend.

This quarter, Intuit reported year-on-year revenue growth of 18.3%, and its $3.89 billion of revenue exceeded Wall Street’s estimates by 3.2%. Company management is currently guiding for a 14.4% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 11.7% over the next 12 months, a deceleration versus the last two years. This projection doesn't excite us and suggests its products and services will see some demand headwinds. At least the company is tracking well in other measures of financial health.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

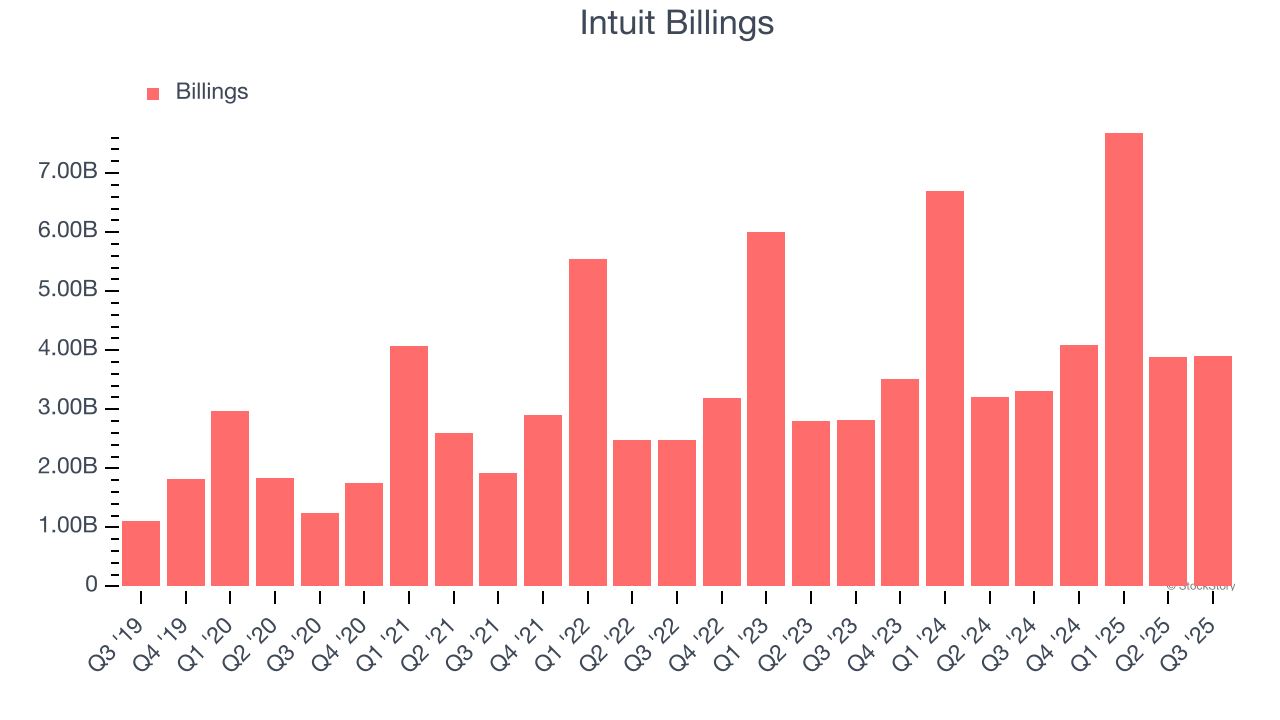

Billings

Billings is a non-GAAP metric that is often called “cash revenue” because it shows how much money the company has collected from customers in a certain period. This is different from revenue, which must be recognized in pieces over the length of a contract.

Intuit’s billings punched in at $3.91 billion in Q3, and over the last four quarters, its growth was solid as it averaged 17.8% year-on-year increases. This performance aligned with its total sales growth, indicating robust customer demand. The cash collected from customers also enhances liquidity and provides a solid foundation for future investments and growth.

Customer Acquisition Efficiency

The customer acquisition cost (CAC) payback period represents the months required to recover the cost of acquiring a new customer. Essentially, it’s the break-even point for sales and marketing investments. A shorter CAC payback period is ideal, as it implies better returns on investment and business scalability.

Intuit is very efficient at acquiring new customers, and its CAC payback period checked in at 23.4 months this quarter. The company’s rapid recovery of its customer acquisition costs indicates it has a highly differentiated product offering and a strong brand reputation due to its scale. These dynamics give Intuit more resources to pursue new product initiatives while maintaining the flexibility to increase its sales and marketing investments.

Key Takeaways from Intuit’s Q3 Results

We enjoyed seeing Intuit beat analysts’ billings expectations this quarter. We were also happy its revenue outperformed Wall Street’s estimates. On the other hand, its EPS guidance for next quarter missed and its full-year revenue guidance was in line with Wall Street’s estimates. Zooming out, we think this was a mixed quarter. The stock remained flat at $639.96 immediately after reporting.

Is Intuit an attractive investment opportunity at the current price? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.